CIL’s Mid-Market M&A Pulse Check offers insights into North American M&A trends, deal activity, and value creation.

Now in its fourth year, CIL’s latest Mid-Market M&A Pulse Check is designed to provide a snapshot of mid-market M&A in North America and identify trends in deal activity and value creation. This year’s results reveal*:

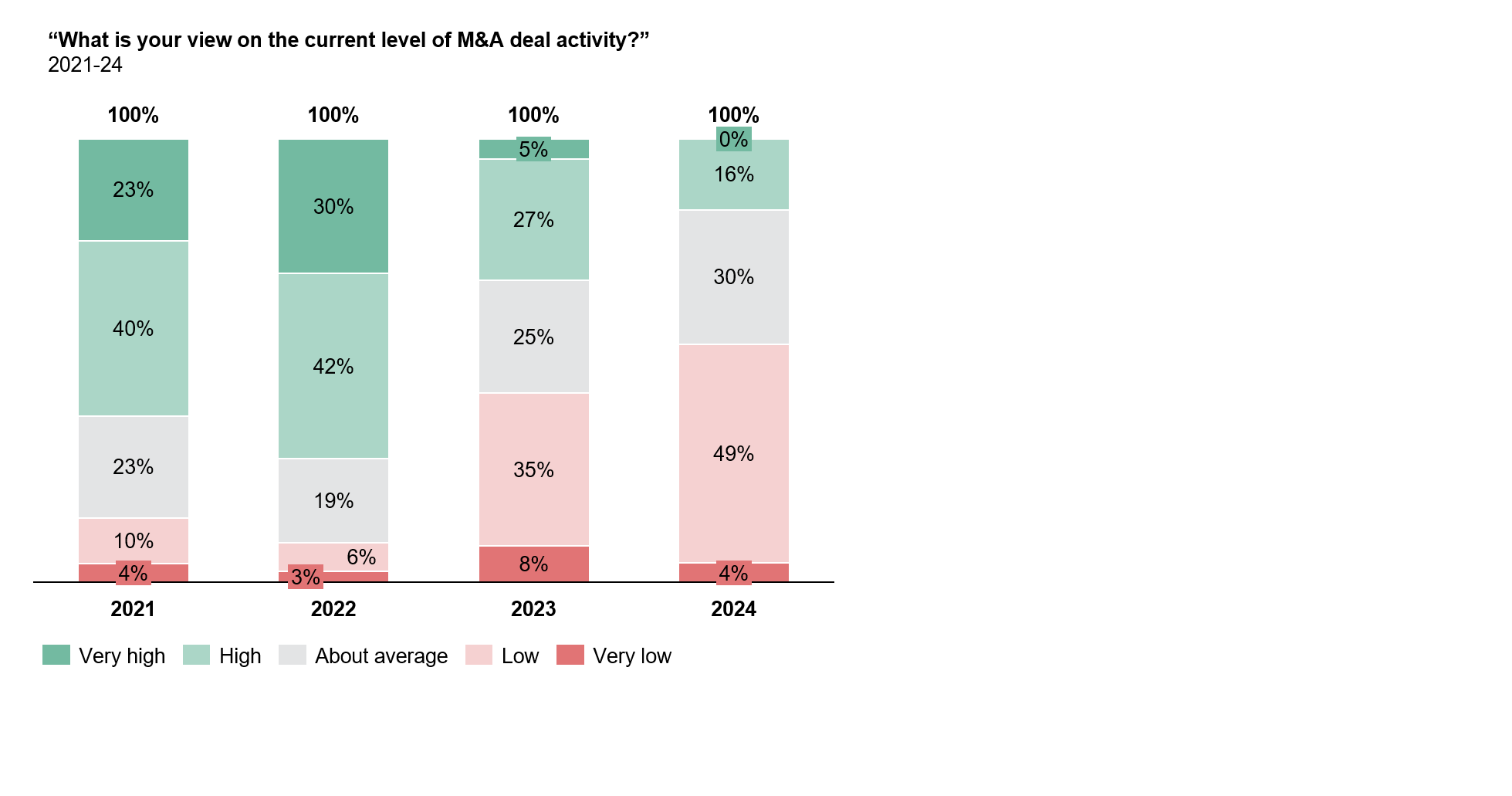

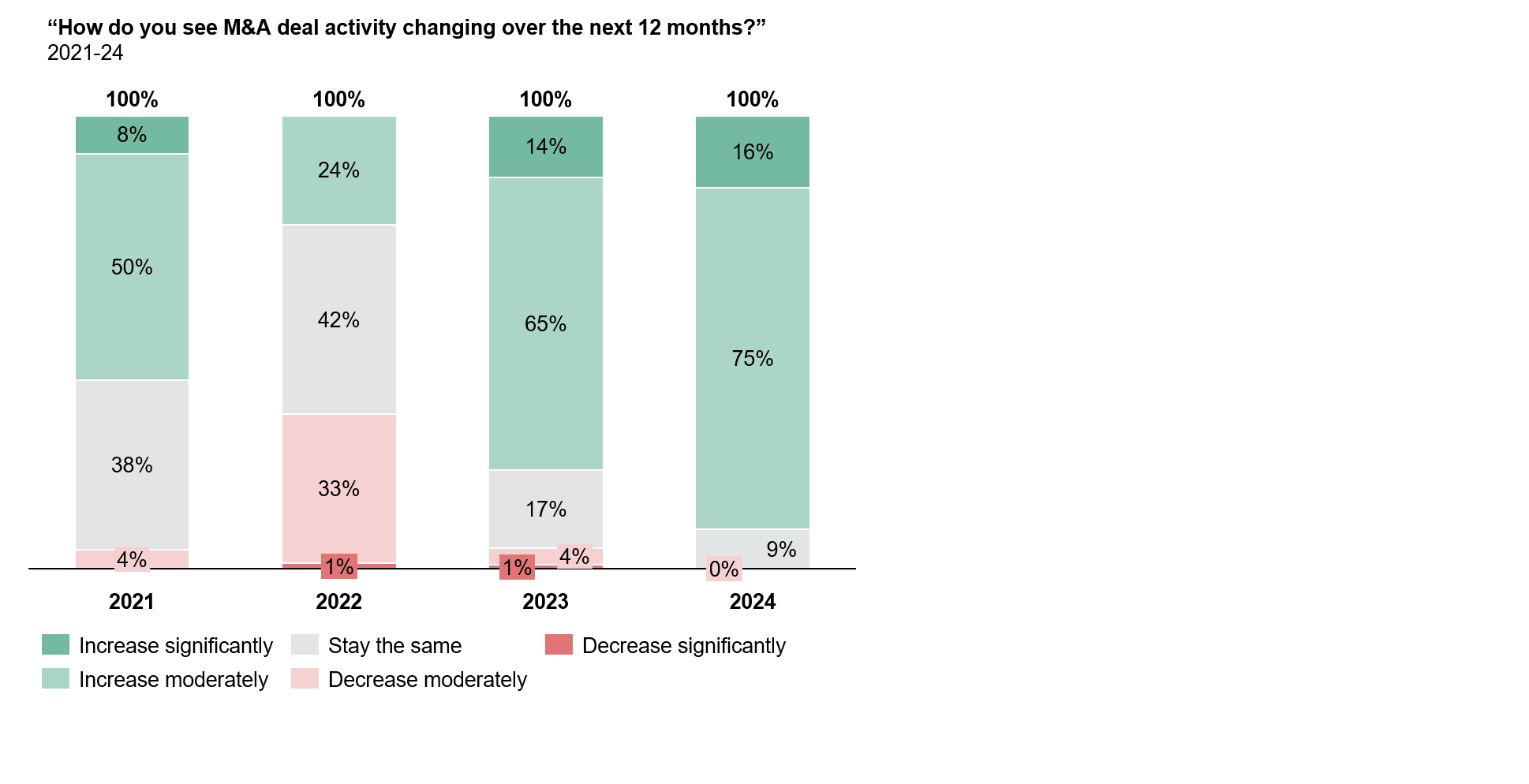

M&A activity remains muted, but the market is optimistic

M&A activity appears to have hit new lows with no respondents viewing current deal activity as very high, and over half of respondents viewing deal activity as low or very low.

But market participants are optimistic, with 91% of respondents expecting M&A deal activity to increase in the next 12 months. Participants, however, have been overly hopeful in the past, giving pause to certainty in a breakthrough in the market.

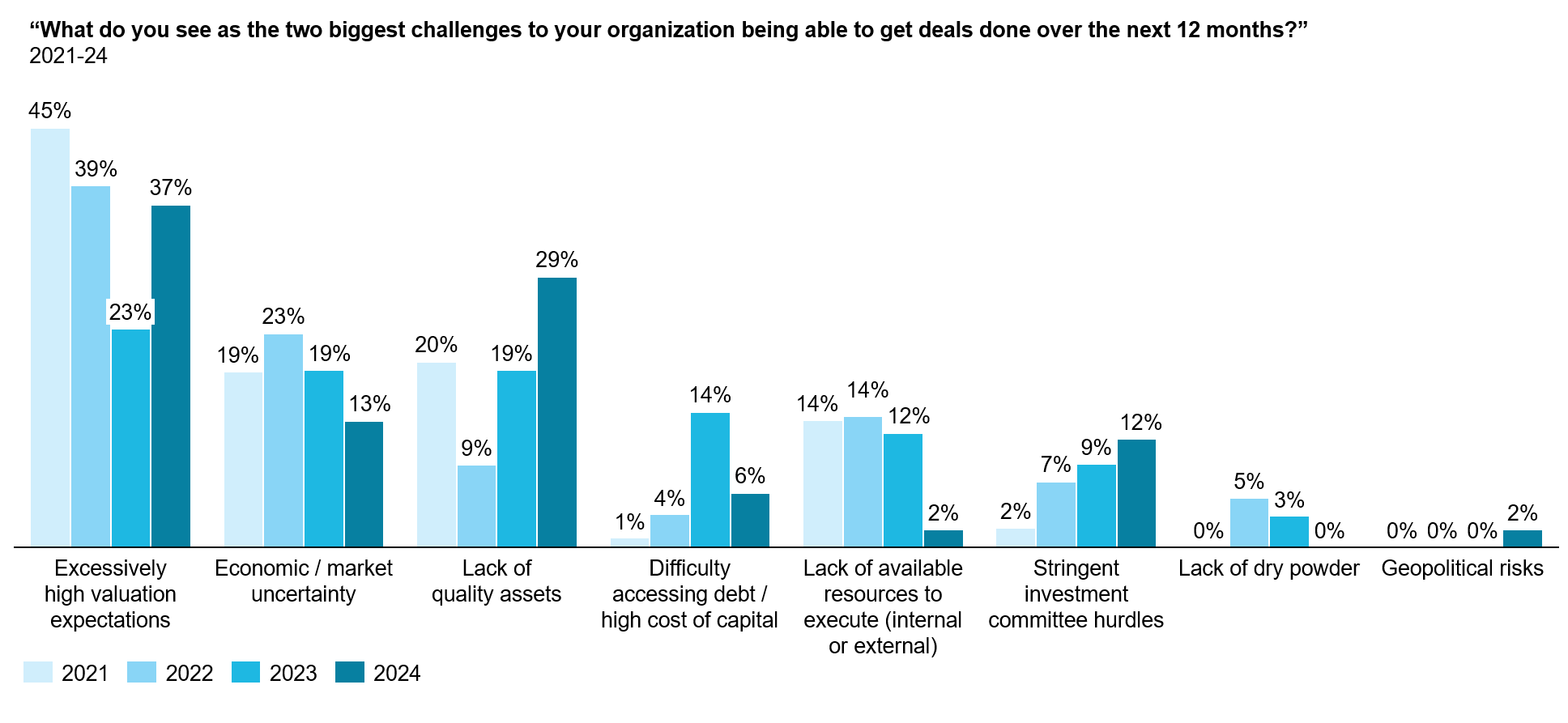

Excessively high valuation expectations pose challenges

Excessively high valuation expectations and lack of quality assets, along with more stringent investment committees are challenging deal completion.

Compared to last year, fewer respondents see economic and market uncertainty as a challenge to getting deals done over the next 12 months, reflecting optimism among respondents about the underlying state of the economy in the coming year.

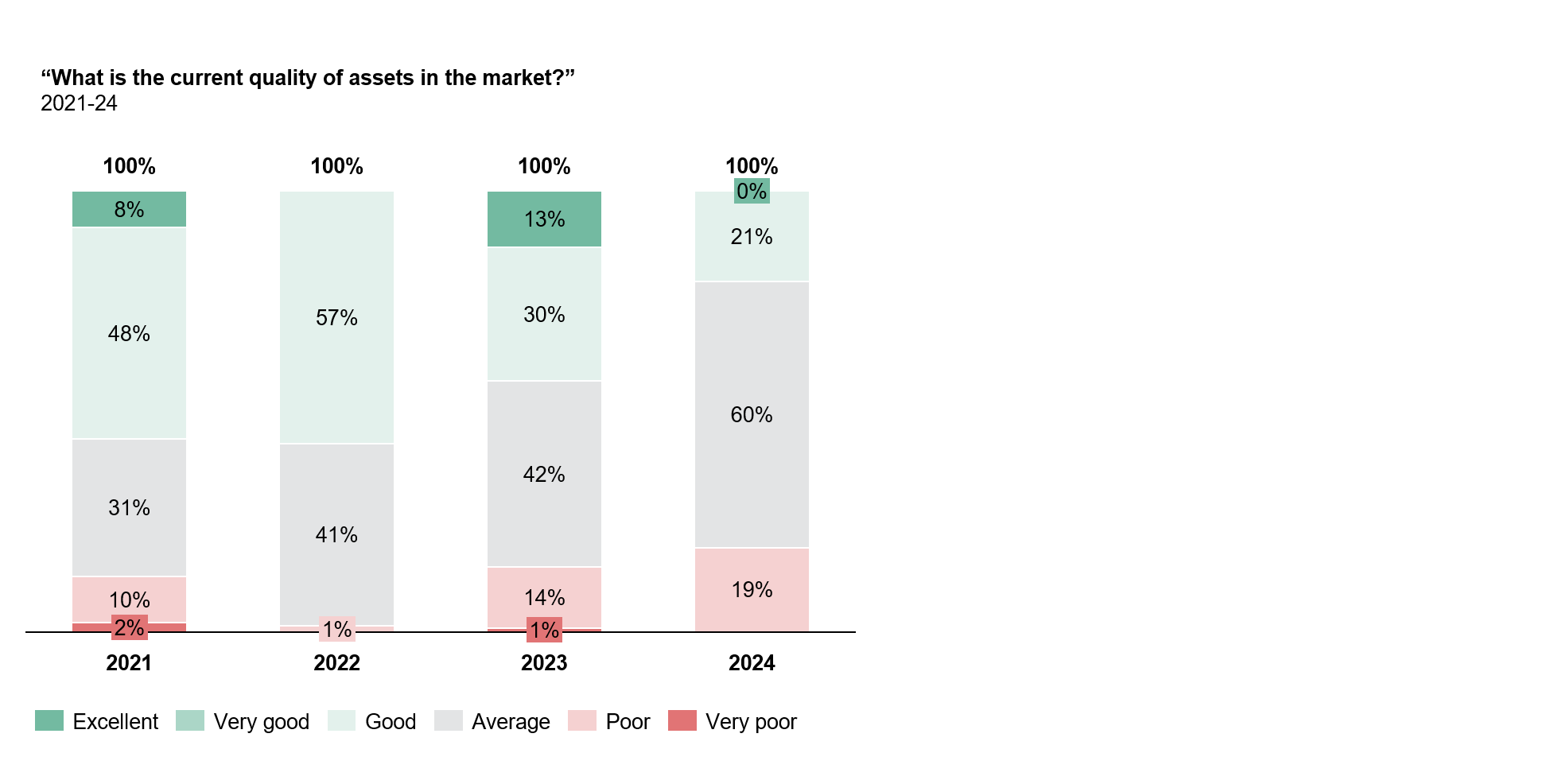

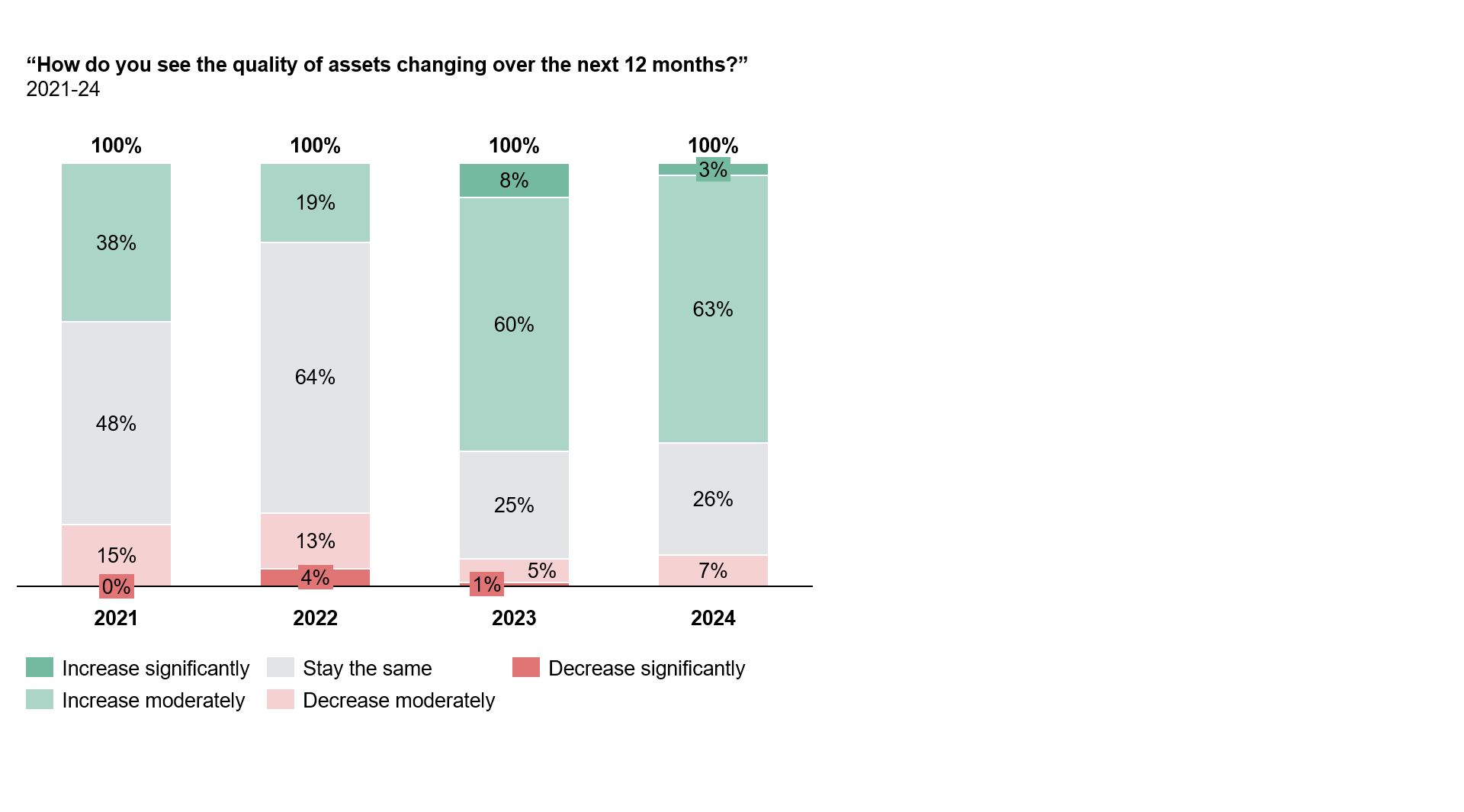

Good quality assets are challenging to find in today’s market

Market participants are feeling less positive about the quality of assets in the market, with ~80% of respondents viewing assets as average or poor. Sellers have waited for more favorable market conditions, and with an expected improvement in conditions, respondents also expect the quality of assets coming to market to improve, although 2024 did not meet the expectations of improvement in assets originally hoped for from our 2023 survey.

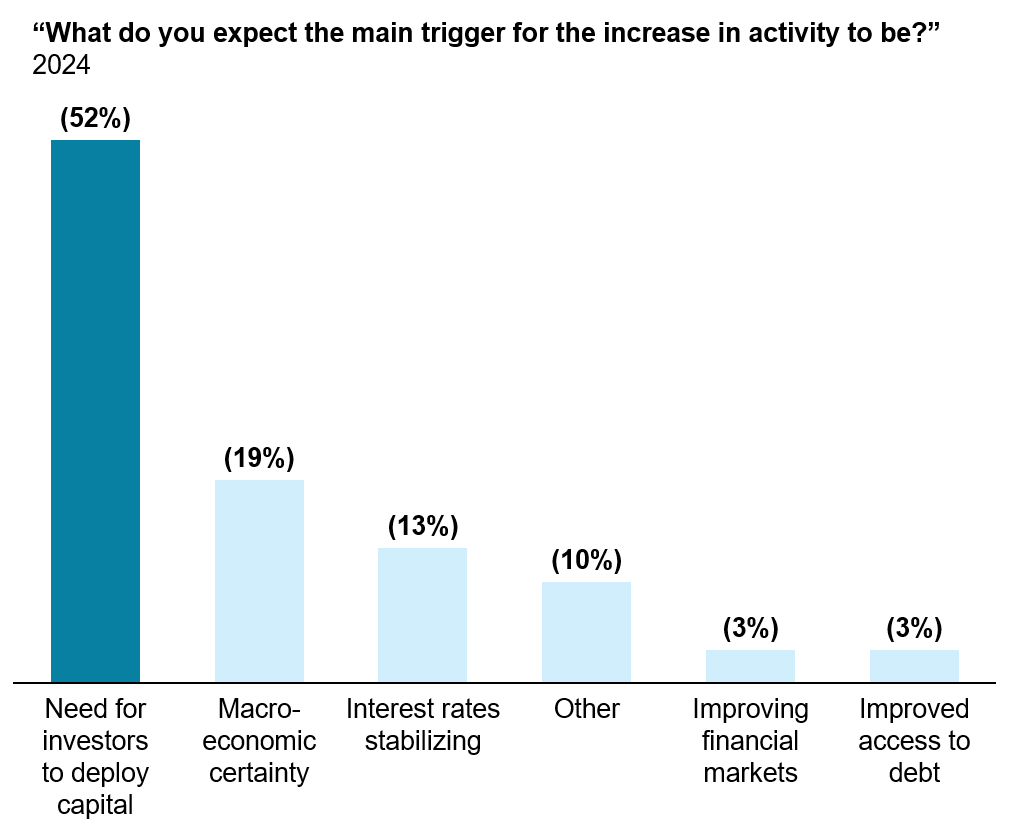

The need to deploy capital is expected to increase market activity

The need to deploy capital is expected to increase market activity

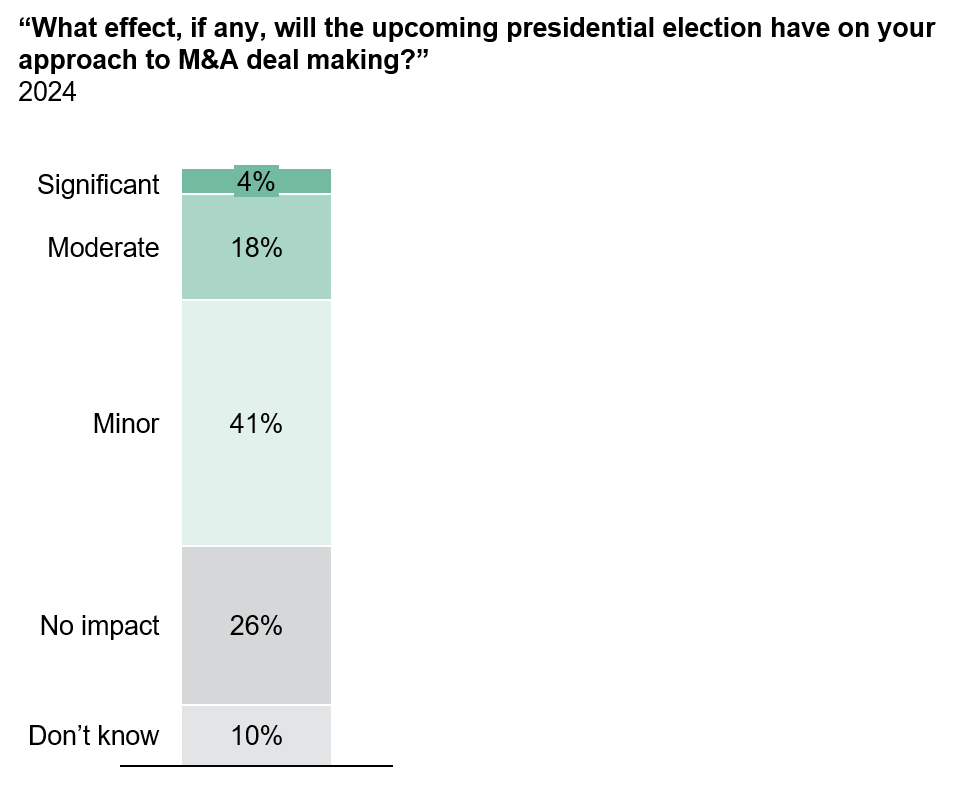

Having continued to delay activity in the hope of better conditions, investors’ need to realize returns and deploy capital has become even greater and is expected to be the primary driver of an increase in market activity, with greater macroeconomic certainty and more favorable interest rates supporting overall optimism. The upcoming election is expected to have negligible impact on decision making, with over two-thirds of our respondents expecting a minor impact to deal making or no impact at all.

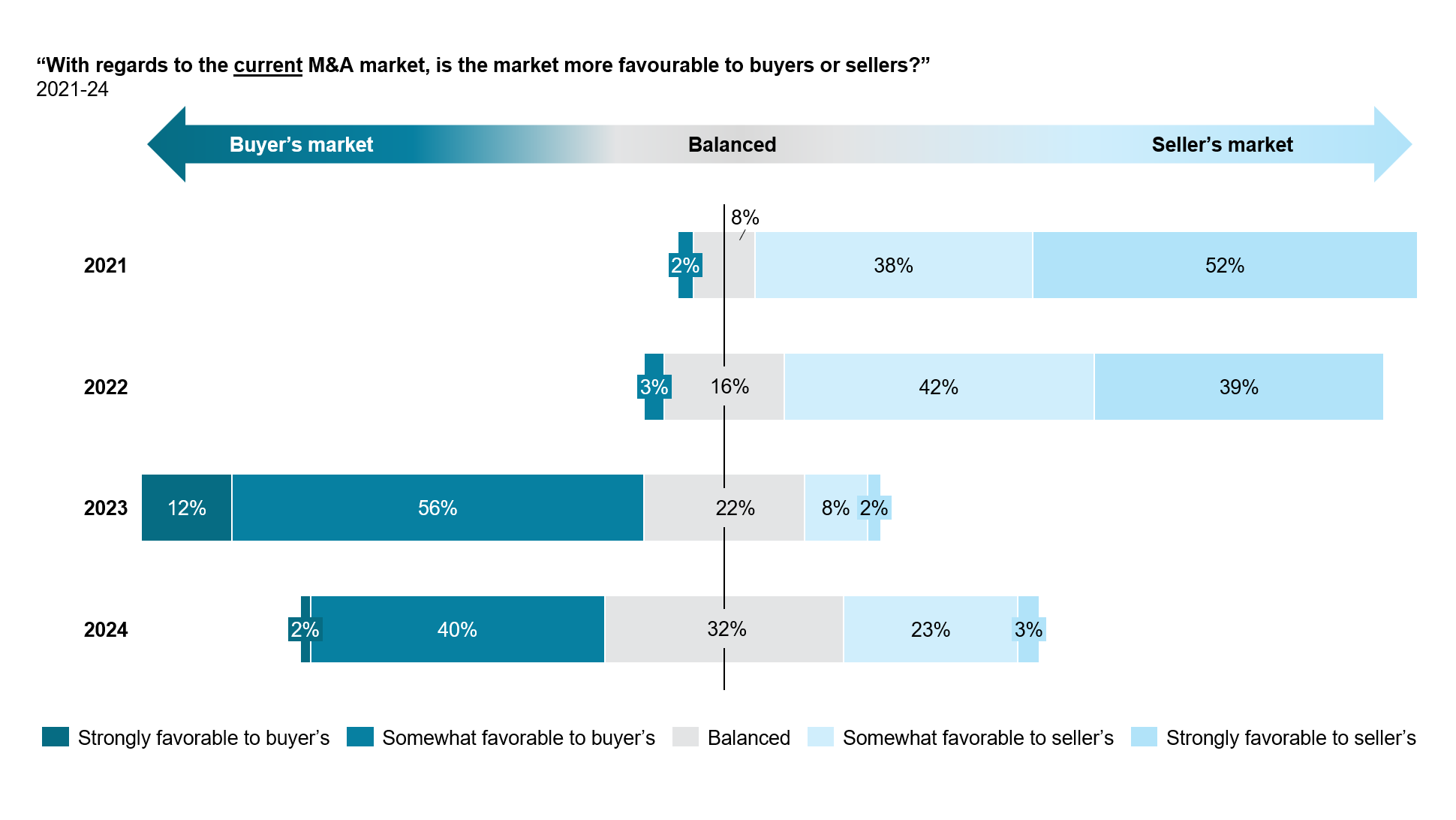

The market appears to be reaching a better balance between buyers and sellers

On a positive note, the market seems to be achieving a better balance between buyers and sellers, indicating that valuation expectations may be starting to converge. The swing towards a buyer’s market seen in last year’s results neutralized in 2024, from 68% seeing the market as more favorable to buyers in 2023 to less than half (42%) in this year’s survey, with 32% viewing the market as balanced.

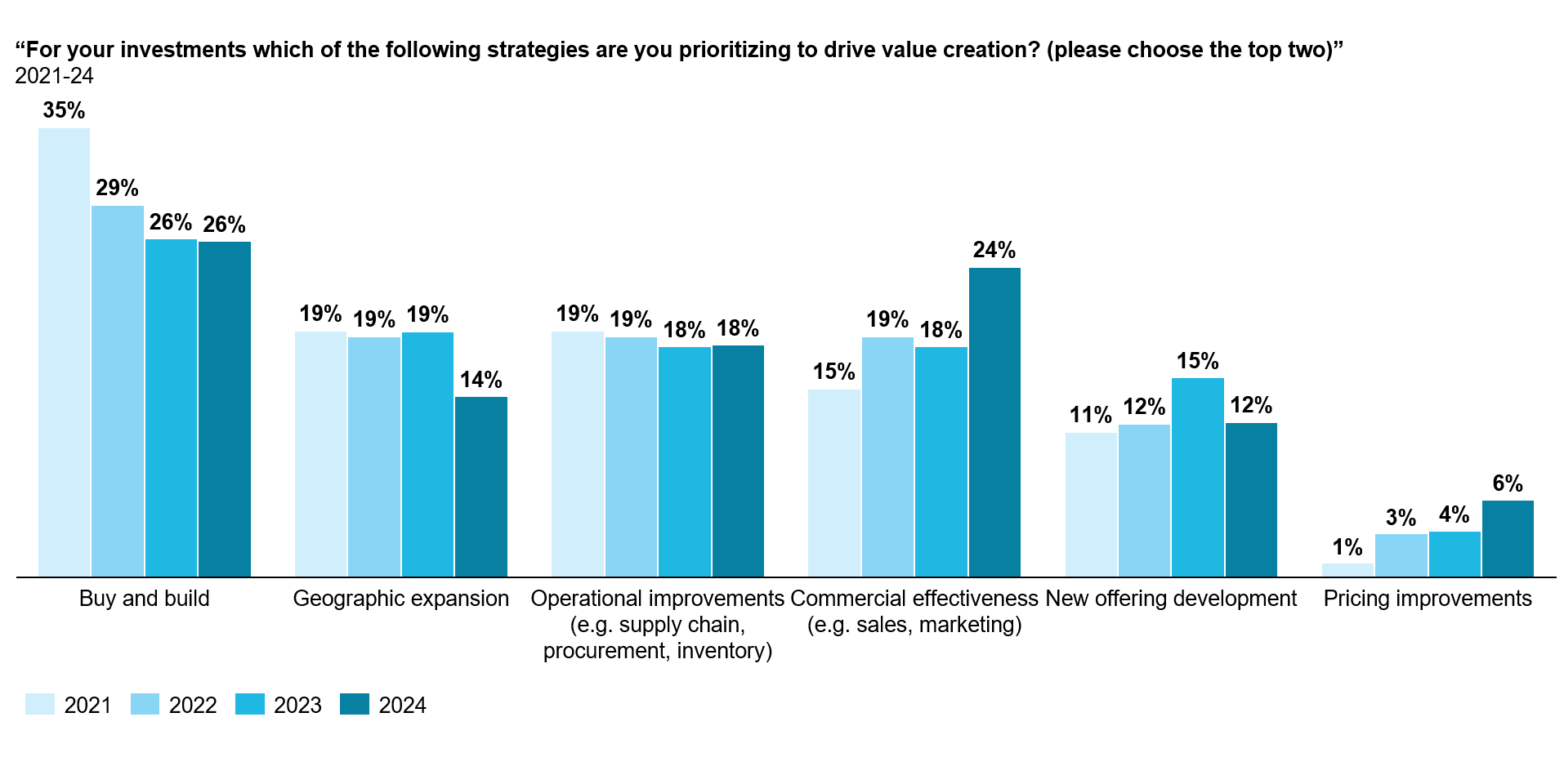

A shift towards organic strategies to drive value creation

In a tougher deal environment, there has been a shift to organic strategies to drive value creation. Over the least four years of the Mid-Market M&A Pulse, we have noticed a trend of respondents increasingly opting to prioritize organic strategies for growth such as commercial effectiveness and pricing improvements in favor of buy and build strategies or geographic expansion. In particular, this year’s results saw a spike in respondents who see commercial effectiveness as a priority for driving value creation, with 24% choosing it as a top priority compared to only 15% in 2021.

Commenting on the Mid-Market M&A Pulse Check findings, Axel Leichum, North America Lead Partner said: “Our M&A Pulse Check shows that private equity and investment bank professionals are optimistic about a near term rebound in mid-market M&A activity in North America. Excessively high valuation expectations and a lack of quality assets remain a challenge, but there appears to be signs of valuation expectations converging, and the increased need to realize returns and deploy capital should push more assets into the market. Time will tell if the optimism we are seeing this year, similar to what we saw last year though it didn’t materialize, turns into reality this time around.”

Get in touch to discuss attractive investment opportunities or how CIL can help drive value creation.

*77 M&A professionals took part in our survey throughout May 2024, with some survey questions receiving fewer responses than others.

Sign up to our mailing list to receive our latest insights.